25+ Fannie mae mortgage rates

Mortgage interest rates may never decrease to less than the ARMs margin regardless of any downward interest rate cap. It is the largest insurer of mortgages in the world insuring over 34 million properties since its.

Hard Money Loan Complete Guide On Hard Money Loan With Example

Today 8222022 the rate for a 30-year fixed-rate mortgage is 513.

. 7 rows september 2022 30 year fixed mandatory delivery commitment mandatory delivery commitment 30-year fixed rate a a. Current Mortgage Rates Data Since 1971 xls Primary Mortgage Market Survey US. Todays Fannie Mae Mortgage Rates Apply Now.

Principal Interest 935. FHA insures mortgages on single-family multifamily and manufactured homes and hospitals. Call us 8889584228 We recognize the importance to you of keeping your information secure and confidential.

Weekly averages as of 09012022 30-Yr FRM 566 011 1-Wk 279 1-Yr 08 FeesPoints. It is the largest insurer of mortgages in the world insuring over 34 million properties since its. We will not sell or share.

Fannie and Freddie require at least. Fannie Mae limits the initial note rate for. A Fannie Mae forecast sees 30-year rates averaging 45 for.

Mortgage Rates Might See Some Relief in 2023 In Fannie Maes previous Housing Forecast for July they expected the 30-year fixed to average 51 in 2023 which actually. 1308 Monthly Mortgage Payment. Lets start with a quick update on mortgage rates.

At the current mortgage rate of 53 percent we estimate that only 14 percent of outstanding loans have a refinance incentive of at least 50 basis points. In fact rates dropped in 2019. Taxes Insurance 225.

25 Year SBA 504. 30- to 180-day commitments. Higher rates apply in Los Angeles and Orange counties for rental mortgage loans from 548251 to 822375 aka a high-balance loan.

Borrowers may lock the rate with the Streamlined Rate Lock option. A Fannie Mae forecast sees 30-year rates averaging 45 for. That turned out to be wrong.

Mortgage rates which have risen significantly just since the start of 2022 may be set to do an about-face in 2023. Excessive prior mortgage delinquency is defined as any mortgage tradeline that has one or more 60- 90- 120- or 150-day delinquency reported within the 12 months prior to. We saw our highest rates of the year this past June with.

This is a non-recourse multifamily loan product for loan amounts starting at 750000 in primary MSAs and 1000000 in secondary MSAs. Non-recourse execution is available. In 2018 many economists predicted that 2019 mortgage rates would top 55 percent.

Fannie Mae is your source for mortgage financing and reliable housing information.

End Of Qe 4 Fed S Repos Drop Below Oct 2 Level T Bills Balloon Mbs Fall Total Assets Down To Dec 25 Level Wolf Street

Iiomn1pl 3gkom

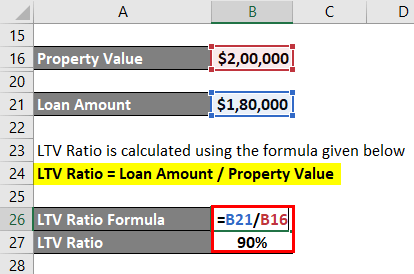

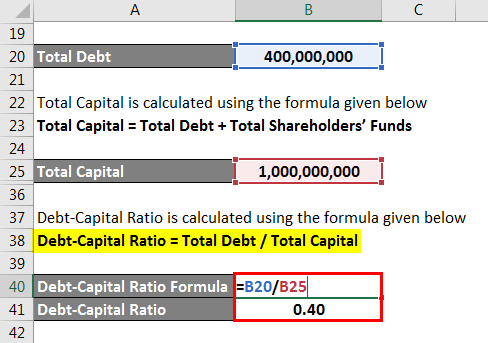

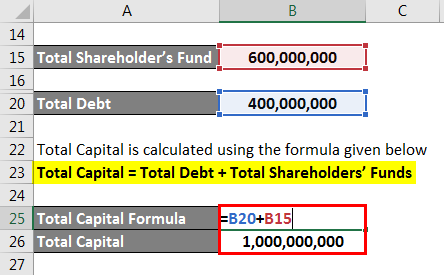

Leverage Ratio Explanation Types And Example

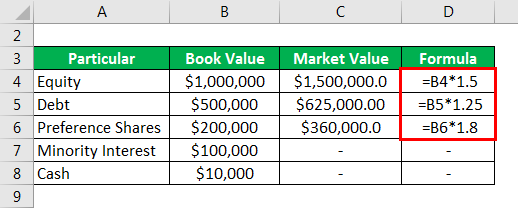

Enterprise Value Explanation Example With Excel Template

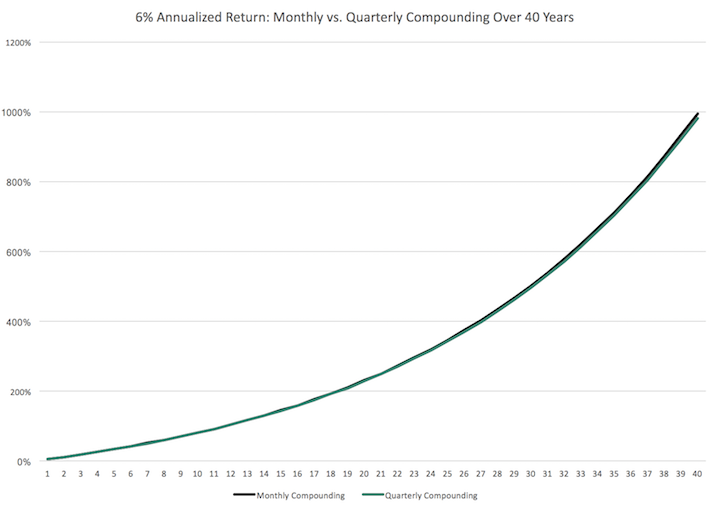

How Much Does The Average Investor Get In Return Quora

2022 Monthly Dividend Stocks List See All 49 Now Yields Up To 17 4

Leverage Ratio Explanation Types And Example

2022 Monthly Dividend Stocks List See All 49 Now Yields Up To 17 4

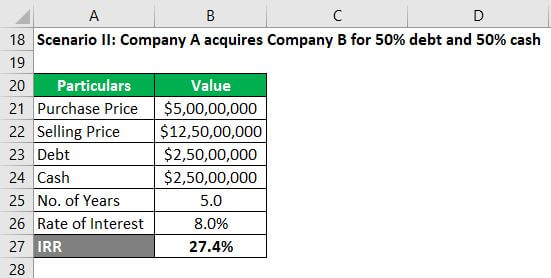

Leveraged Finance Effects Of Leveraged Finance With Example

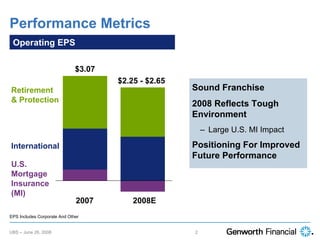

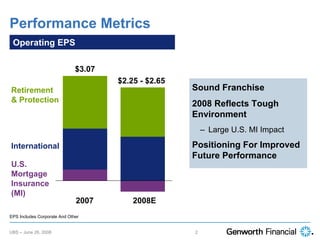

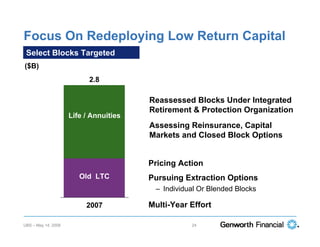

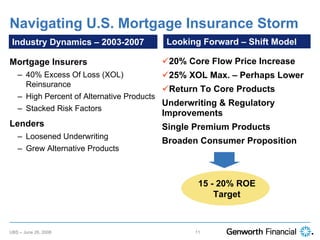

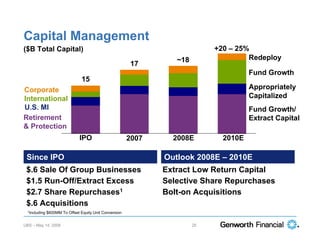

Gnw 20at 20ubs 20global 20insurance 20conference

Gnw 5 14 08 20gnw 20at 20ubs 20global 20financial 20services

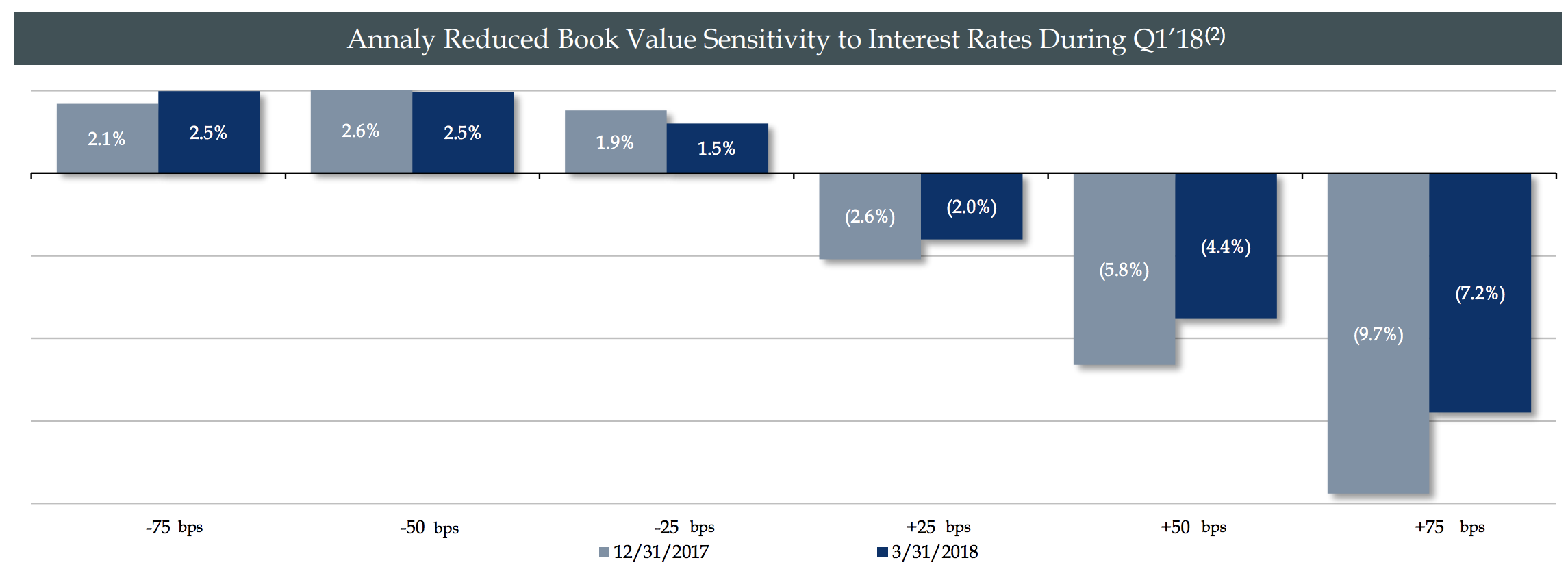

A Guide To Investing In Mortgage Reits

What Will You Do To Get Wealthy During The Next Financial Crisis Quora

End Of Qe 4 Fed S Repos Drop Below Oct 2 Level T Bills Balloon Mbs Fall Total Assets Down To Dec 25 Level Wolf Street

Gnw 20at 20ubs 20global 20insurance 20conference

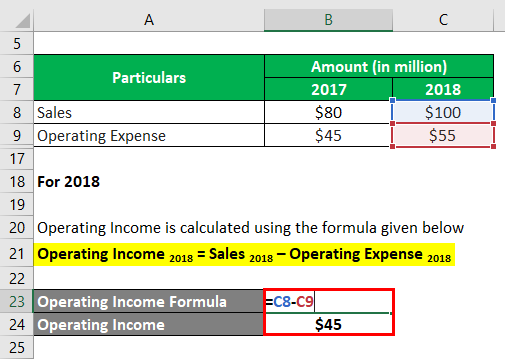

Degree Of Operating Leverage Defintion Examples With Excel Template

Gnw 5 14 08 20gnw 20at 20ubs 20global 20financial 20services